2025 Fsa Contribution Limits Over 55. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

The 2025 maximum fsa contribution limit is $3,200. For 2025, there is a $150 increase to the contribution limit for these accounts.

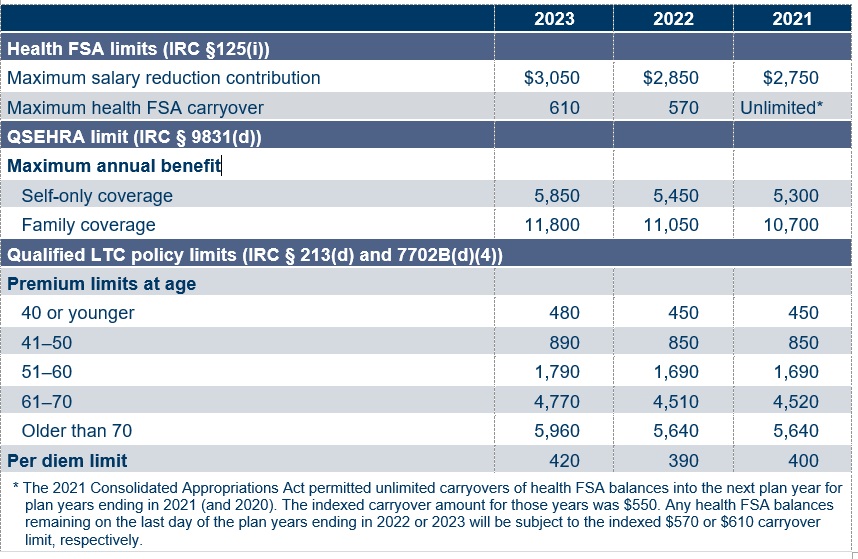

IRS Announces 2025 Increases to FSA Contribution Limits SEHP News, Participants 55 and older can contribute an extra $1,000 to their hsas.

Dependent Care Fsa Contribution Limit 2025 Dedra Bethena, The irs establishes the maximum fsa contribution limit each year based on inflation.

Fsa Family Limit 2025 Over 65 Tani Zsazsa, For 2025, you can contribute up to $4,150 if you have individual coverage, up.

2025 Hsa Contribution Limits And Fsa Funds Toni Agretha, For 2025, there is a $150 increase to the contribution limit for these accounts.

Fsa 2025 Contribution Limit Irs Kali Samara, For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions.

Health Fsa Contribution Limits 2025 Pdf Dasha Marilyn, Use this information as a reference, but please visit irs.gov for the latest.

2025 Hsa Contribution Limits And Fsa Accounts Grier Celinda, If the fsa plan allows unused fsa.

The IRS Has Increased Contribution Limits for 2025 — Human Investing, If you’re 55 and older, you can contribute $1,000 more each year.